Introduction

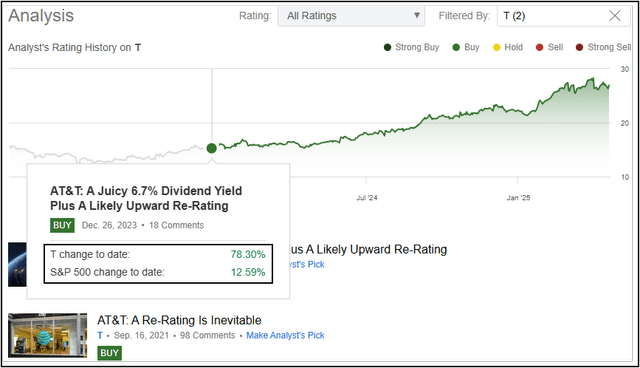

After initiating coverage on AT&T (T) with a "Buy" rating in September 2021, I reiterated my bullish stance on the telecom giant in December 2023:

With its earnings (~14.7%) and dividend (~6.7%) yield being greater than short-term (2-yr: 4.33%) and long-term (10-yr: 3.89%) treasury yields, AT&T is undoubtedly an enticing dividend investment. As we saw in this note, AT&T's above-industry average dividend yield of 6.7% is well covered by its free cash flows. Given management's commitment to the dividend and robust cash generation potential of AT&T's connectivity services business, another dividend cut (or pause) seems very unlikely for the foreseeable future.

Despite AT&T's highly leveraged balance sheet, I view AT&T as a good hideout for investors looking to safeguard themselves from violent market gyrations in the next 1-2 years. AT&T is a (utility-like) reliable cash flow generator that will continue to produce tons of free cash flow even during recessionary periods. From a valuation perspective, AT&T is currently undervalued, and the risk/reward is attractive enough to warrant a new long position. In my view, T's 6.7% dividend yield is safe, and there's a very good chance of significant capital appreciation in AT&T's stock in 2024-25. Henceforth, I continue to rate AT&T a "Buy" for dividend investors.

Key Takeaway: I rate AT&T a long-term "Buy" at $16.5 per share

Source: AT&T: A Juicy 6.7% Dividend Yield Plus A Likely Upward Re-Rating

Since then, AT&T's stock has absolutely annihilated the market [S&P-500 (SPY)] on a total return basis, driven by a powerful mix of dividends and capital appreciation [powered by an upward re-rating in trading multiples].

Now, while AT&T's recent financial performance has trended in the right direction and the telecom giant's deleveraging is progressing quite nicely, the sharp decline in AT&T's dividend yield from ~7% to ~4% [under risk-free treasury yields: 4-4.5%] begs the question - "Is AT&T Still A Good Buy?"

To answer this question, we shall analyze AT&T's business trends and re-run the stock through TQI's Valuation Model in today's report. Let's go!

AT&T: By The Numbers

Since returning to its core roots of connectivity services by exiting the media business (through partial sales of DirecTV (late-2021) and WarnerMedia (mid-2022)), AT&T's top-line growth rates have been fluctuating around the flat line, but have largely stayed in positive territory:

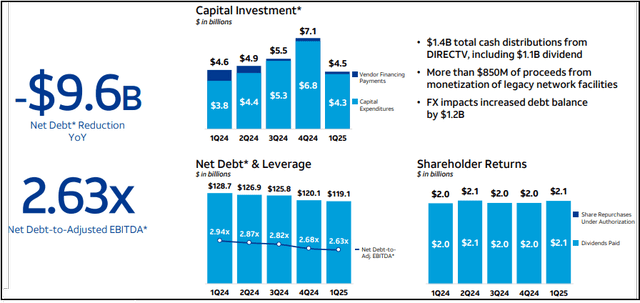

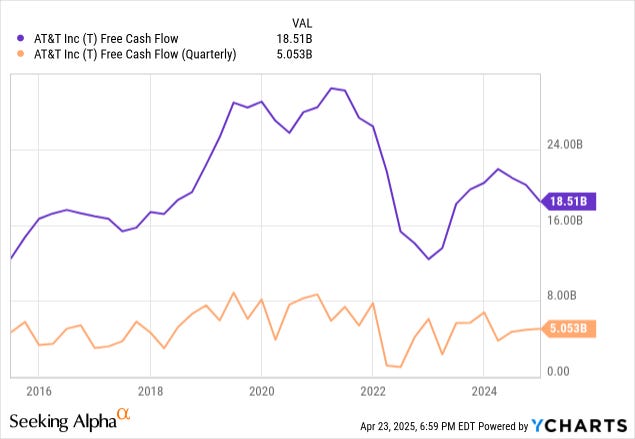

And, while free cash flow generation has been somewhat wobbly, AT&T's deleveraging has been progressing quite well, with the Net Debt to adjusted EBITDA ratio improving to ~2.63x as of the end of Q1 2025, and on track to hit management's operating target of ~2.5x in the first half of 2025:

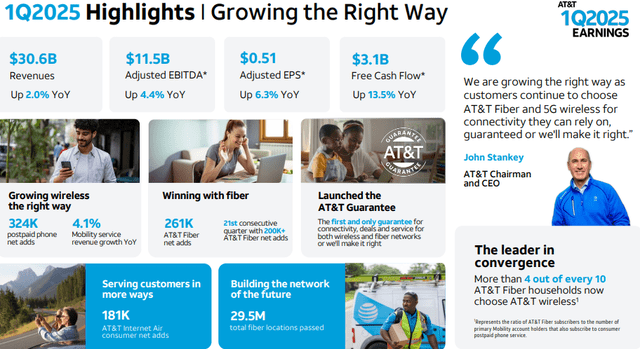

Now, in its latest quarter, AT&T showcased continued strength in 5G and Fiber offerings with robust customer additions (Postpaid Net Adds: +324K, Fiber Net Adds: +261K) and healthy ARPU expansion.

However, with AT&T's business wireline segment ($4.5B, -9% y/y) still weighing on top-line performance, overall sales totaled $30.6B, representing a year-over-year increase of only ~2%.

On a more positive note, AT&T's margins are trending in the right direction, with adj. EBTIDA and free cash flow outpacing revenue growth, rising +4.4% y/y and +13.5% y/y in Q1 2025.

Now, while tariffs have led to many guidance pulls during this earnings season, AT&T's management reaffirmed its outlook for 2025 -> projecting low single-digit top-line and adj. EBITDA growth.

Furthermore, AT&T's capital return program is set to be bolstered by a $10B buyback program [guided stock repurchases - $3B in 2025, $7B in 2026].

In my view, AT&T and Verizon (VZ) are utility-like companies that would serve as reliable cash flow machines for shareholders through recessionary periods. That said, valuation matters when making investment decisions.

AT&T Fair Value And Expected Returns

Considering its enterprise value of ~$315B and projected 2025 FCF of $16B+, AT&T is trading at an EV/FCF multiple of ~20x, which is roughly in line with broader market multiples [S&P-500 trading at ~21-22x forward earnings].

Further, as we know, AT&T is a mature low-growth business, which is comparable to a long-term bond. Given its earnings yield of 5.48%, AT&T currently offers a +1% equity risk premium over the 10-year US Treasury bond that's yielding 4.4%. From a return perspective, it still makes sense to own AT&T over risk-free treasury bonds.

From an absolute valuation standpoint, AT&T now appears fully valued based on conservative assumptions for future growth and margins:

As you can see above, AT&T is worth ~$26.6 per share (or ~$192B in market cap), i.e., the stock is marginally overvalued at current levels.

Please note, I haven't factored in AT&T's [net] debt load of ~$120B because I expect the company to carry a big chunk of this debt for many, many more years (potentially decades) to come (any deleveraging will be done using future free cash flows at management's discretion).

Furthermore, we have factored AT&T's dividend into our calculation using it under "Buyback as a % of FCF" and effectively treating it as a drip reinvestment. Also, AT&T's upcoming buyback program is baked in here too.

The model assumptions are pretty straightforward, but if you have any questions, please share them in the comments section below.

Assuming a conservative exit multiple of 10x P/FCF for 2030, we get a $39.2 price target for AT&T. This price target implies an expected CAGR return of ~7.61% over the next five years, which is roughly in line with S&P500's long-term annual return of 8-10% but well short of TQI's investment hurdle rate of 15% per year. Therefore, I am downgrading AT&T stock to a "Hold" rating.

Concluding Thoughts

As a recession hideout, AT&T is still a decent stock to own. However, fresh capital allocation in AT&T is unjustified given the significant price appreciation experienced over the past eighteen months.

Key Takeaway: I now rate AT&T a "Hold" at $27.2 per share

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.