[Bonus Report] TQI's Asymmetric Stock Idea For March 2024

Get a taste of what TQI's Asymmetric Ideas Series can do for you...Our March pick is already a 5.5x bagger, and there's still lots of upside ahead!

Hello,

I hope this note finds you well. At the start of this year, I committed to providing increased value to all of our newsletter subscribers, i.e., YOU.

While it took a while for me to get the research distribution balance right, I believe we are now achieving reasonable success on this front with

1] TQI’s Asymmetric Ideas Series [Paid]

2] Updated newsletter format, i.e., video summaries for my public research work [Free]

I am truly grateful for your continued support and motivation. To express my gratitude, I am sharing one of TQI’s Asymmetric Ideas Series notes with you today.

Note: This was published to TQI Tidbits (Paid) members and TQI subscribers at SeekingAlpha on 18th March 2024. Since then, AST Spacemobile (ASTS) has more than 5x’ed from our recommended buy level [~$3.15 per share], and as you’ll learn in this note, we could still be looking at a ~7.5x-24x bagger from here [~$18 per share]. Given its incredible run-up, I prefer staggered buying via DCA over a lump sum buy now, but ASTS 0.00%↑ is still an incredibly lucrative investment idea.

If you do enjoy this note, please share this post as far and wide as you can.

Alright, here’s what I wrote back in mid-March 2024:

TQI's Asymmetric Stock Idea For March 2024

Welcome to the 12th edition of TQI's Asymmetric Ideas series, wherein we strive to find investments that can produce 50-100%+ returns in 1-3 years with limited risk. Since launching this exclusive monthly series in April 2023, our first 11 asymmetric risk/return ideas have generated ~26% return on average as of writing on 17th March 2024.

Jeff Bezos (Amazon's Founder & Chairman) once quipped -

Given a 10% chance of a 100 times payoff, you should take that bet every time

And in that spirit, I would like to introduce you to our next asymmetric stock pick (one where I see a reasonable path to 100x) -

What Is AST Spacemobile?

AST Spacemobile (ASTS) is a vertically integrated direct-to-cell technology company that's building the world's first space-based cellular broadband network that can connect directly to unmodified everyday smartphones.

Source: YouTube

What Makes AST Spacemobile An Asymmetric Investment Opportunity?

From a global population of 8 Billion, roughly 5.5 Billion people are cellular subscribers today, of which 1 Billion have no cellular broadband. And then there are another 2.5 billion who are simply unconnected!

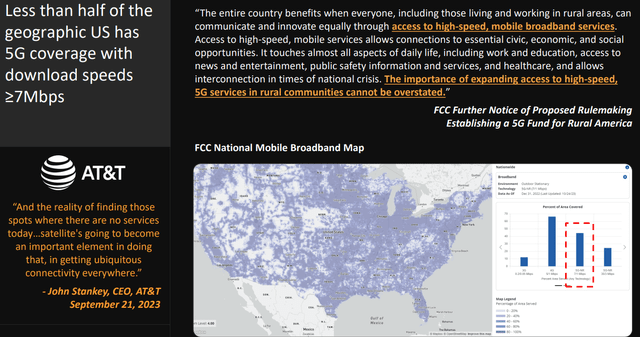

To fill this coverage gap (and connect the unconnected), AST Spacemobile is building a unique (first-of-a-kind) low earth orbit [LEO] satellite constellation that will enable unmodified everyday smartphones to access high-speed broadband (text + voice + data) anytime, anywhere on the planet.

While space-based communication has been around for a while, AST Spacemobile's direct-to-cell technology is set to unlock mass-market mobility (TAM of $1T+) by eliminating the need for high-cost infrastructure tied to terrestrial cellular networks and legacy space-based communication methods such as proprietary satellite phones & provider-specific antennas.

Since de-SPACing in 2021, the AST Spacemobile story has been marred by delayed timelines primarily caused due to supply-chain issues, and as of now, AST Spacemobile is still pre-revenue (awaiting the launch of its first 5 commercial Bluebird satellites [in Q2 2024]). However, in the testing phase with its BlueWalker3 prototype satellite - AST Spacemobile has proven its direct-to-cell capabilities across 2G, 4G LTE, and 5G connectivity with text, voice, and data (download speeds up to 14Mbps).

In terms of competition, SpaceX's Starlink appears to be the only real threat to ASTS in the direct-to-cell market, and while they have shown text capability through 4G LTE, voice and data are unlikely to be solved until next year or 2026, according to T-mobile's recent announcement. Clearly, AST Spacemobile has a technology leadership right now, which they can exploit to gain a significant first-mover advantage in the near future.

Over the past year, we have seen other companies pull their hands up on a me-too offering. But clearly, when you get into their details, they are not broadband scalable or compatible with today’s smartphones. This is a hard problem, which has a lot of different elements for success. And we have been entirely focused on development of these systems since the funding of our company in 2017.

We had invested over $700 million to date in this effort, resulting in over 3,100 patent and patent-pending claims and our own vertically ready manufacturing capabilities for our satellites. AST SpaceMobile critical differentiation is that we are the first and only system designed for 5G cellular broadband.

We have shown the ability to achieve 5G data rates as well 4G and 2G. Other systems today are far away from being able to achieve what we have and are primarily narrowband techs and emergency service offering. Our very large phase array antenna, combined with our own ASICs is unique in this space and is critical for achieving 5G directly to existing everyday smartphone to scale up to serve the needs of the 5 billion phones in circulation in partnership with the leading and largest MNOs on the planet.

- Abel Avellan, AST Spacemobile CEO on Q3 Earnings Call

According to AST Spacemobile's leadership, their total constellation will consist of 168 satellites in the long run, with 110 satellites enough to achieve substantial global coverage. However, in the first phase of commercialization, AST Spacemobile is looking to launch a block of five bluebird satellites (with a target launch date currently standing at June 2024).

While the company's initial plan was to launch its commercial services in equatorial countries first, management has now updated its plan based on customer feedback (at an additional cost of $5M), with the first 5 commercial satellites set to be put in a higher orbit such that North America and most of Europe lie within the coverage area (marked in black lines below):

Now, with the first five satellites, AST Spacemobile will only be able to provide limited, non-continuous services in its coverage area; however, successfully executing phase 1 will demonstrate Spacemobile's technological capabilities to the world, and at that point, funding risk will no longer be a thing.

Yes, AST Spacemobile still has technological and regulatory hurdles to overcome before it can fulfill its mission of connecting the unconnected and enriching 1B+ lives. That said, with 40+ MNO partners and several strategic investors, AST Spacemobile has a very good chance of success [much, much greater than 10%].

Now, how big of an opportunity is this? Are we looking at a potential 100x investment idea?

Napkin Math For This Investment

Since AST Spacemobile is still pre-revenue, putting a fair value estimate on the company is imprudent. And so, we will look at some paper napkin math to see if this speculative investment is worth our time and money!

Among its 40+ MNO partners, AST Spacemobile will have distribution to over 2B+ cellular subscribers after commercialization of its service. In its SPAC deal presentation, AST Spacemobile laid out the prospect of having 440M subscribers globally by the end of this decade with a monthly ARPU of $2.70.

Given we are already running a couple of years behind those aggressive timelines, I wouldn't put too much weight on these lofty assumptions.

Assuming the constellation buildout goes smoothly from here on out, I think AST Spacemobile could realistically amass a subscriber base of 245-490M over the next 8-10 years [100-200M (10-20% of 1B cellular subscribers with no cellular broadband) + 45-90M (1-2% of 4.5B cellular subscribers with broadband) + 100-200M (subscribers with no existing cellular coverage)].

According to AST Spacemobile's projections, monthly ARPU will settle at $2.70, with equatorial countries having a far lower estimate of ~$1.03 vs. ~$7.62 for US, Canada, & European countries. With most of AST's subscribers likely to come from equatorial countries, let us conservatively assume the monthly ARPU lands at $1.35 (half of management's projections).

Multiplying these numbers, we get to an annual revenue of $4 to $8B.

With a super-wholesale model, AST Spacemobile expects to generate 90%+ EBITDA margins over the long run, but just to be safe, let's assume an optimized FCF margin of 75% (leaving enough room for maintenance CAPEX).

Under these assumptions, AST Spacemobile could generate $3 to $6B in annual free cash flow. Applying a very conservative exit multiple of 10-20x P/FCF, AST Spacemobile could command a $30-120B market cap!

Considering ASTS' current market cap of ~$800M, AST Spacemobile could prove to be a 37.5x to 150x bagger from current levels, and this can happen within the next ten years!!!

Why Now?

We have known about AST Spacemobile for quite some time, owning it since July 2023 within TQI's Moonshot Growth Portfolio strategy, wherein we have limited our target position size for ASTS to 1% with the idea of being willing to lose that 1%.

What's the trigger for including ASTS in TQI's Asymmetric Ideas List now?

Despite expecting AST Spacemobile to face many more technological and regulatory hurdles in the near to medium term, I am now convinced about AST's technological edge (after looking at BlueWalker3 5G test successes and studying multiple rivals' current capabilities). As I see it, AST Spacemobile has a clear first-mover advantage, and I think its robust MNO partnerships and vast patented IP are likely to serve as a high barrier to entry in the direct-to-cell market.

So far, I have shied away from allocating meaningful capital to ASTS stock, with funding/liquidity risk at the top of my mind. At the end of Q3 2023, AST Spacemobile had only $135M of cash and cash equivalents left on the balance sheet, with the company's operating expenses running at ~$40M per quarter and Q3 CAPEX of $70M. While CAPEX spending was expected to drop sharply in Q4 2023, AST Spacemobile had less than 2-3 quarters worth of runway left!

These liquidity fears have now been allayed, with AST Spacemobile raising more than $210M from strategic ($110M convertible debt) and public investors ($100M equity offering) in early 2024.

While AST's commercial satellite launch seems to be pushed out to June 2024 [Q2], and there could be further delays, AST Spacemobile's operating expenses are set to drop to $25-30M per quarter as non-recurring R&D expense is over. After factoring in AST Spacemobile's existing cash position and the latest capital raise, I now believe we have a 12 to 18-month runway, which is enough to complete the Phase 1 launch and a good bit of work on Phase 2. Also, once AST Spacemobile starts generating revenue, I see cash burn issues abate and more capital market funding opportunities to support the constellation buildout.

Even with commercialization in sight, Mr. Market has sent ASTS stock back down to the low $3s in light of its recent secondary public offering. And, in my view, this pullback is the right moment to pounce on ASTS stock.

As you may know, AST Spacemobile has a proven leadership team, with Abel Avellan (Founder and CEO) leading the charge since the company's inception in 2017. Before AST Spacemobile, Avellan was the founder and CEO of Emerging Markets Communications (a satellite service provider) until its sale for $550M in 2016. Interestingly, Mr. Avellan seed-funded AST Spacemobile with his personal funds, and as of March 2024, he still owns more than 30% of AST Spacemobile. With a large majority of his net worth tied to ASTS, I believe Avellan's financial interests align well with those of ASTS stock investors.

In addition to proving their Direct-to-Cell technology's capability, AST Spacemobile's leadership team has showcased an ability to strike strategic partnerships and attract capital in the face of adversity. Even in the case of a future liquidity crisis (if there were to be one), I would expect AST's leadership to keep the company afloat.

Lastly, I think AST Spacemobile's vertically integrated manufacturing advantage is truly underappreciated. With its two facilities based in Midland (Texas), AST Spacemobile can currently manufacture 2 Bluebird satellites per month with a capacity of 6 per month. The FPGA-based system used in Block 1 Bluebird satellites (~693 sq. ft. phase array) has a processing bandwidth of 1GHZ; however, with the next generation of Bluebird satellites (~2,400 sq. ft. phase array) custom ASICs (designed by AST Spacemobile, to be manufactured by TSMC (TSM)) are set to boost processing bandwidth by 10x to 10GHz whilst reducing power consumption. Furthermore, unlike with BlueWalker3 prototype, AST Spacemobile can now perform all component-level and satellite-level testing within its facilities, which ensures better control over the testing process. As I see it, AST Spacemobile has a technological advantage over competitors, and it is hard at work to expand this further.

As of now, I think AST Spacemobile will achieve commercialization in the back half of this year, and once that happens, its stock will no longer be priced for failure like it is right now. This is the window of opportunity to buy ASTS stock!

AST Spacemobile's Technical Setup

From a technical perspective, ASTS looks like a coiled spring ready for lift-off! After breaking out of a nearly 3-year-long descending/falling wedge pattern in late 2023, ASTS has pulled back down to re-test that breakout in early 2024. With ASTS trading under 50-DMA & 200-DMA levels, the stock could continue to slide lower in upcoming months (extending the falling wedge pattern); however, for now, the re-test of the wedge breakout is proving to be successful, and the longer ASTS holds above its recent low of $2.59, higher the probability of a sharp ascent in ASTS stock.

As of now, I am constructive on AST Spacemobile's chart; however, a sustained breakdown below $2.59 (the recent low) could send ASTS stock spiraling down into the $1-2 range.

Essentially, if AST Spacemobile successfully launches its commercial operations with 5 satellites in Q2/Q3 2024 [i.e., ASTS exits the pre-revenue stage], then the stock could absolutely fly up in the rest of 2024. On the other hand, further delays due to technological or regulatory hurdles could once again ignite liquidity fears that can push ASTS stock lower.

Risk Mitigation Strategy

Note: For investors looking to reduce the volatility (and eliminate bankruptcy risk) involved in taking a truly contrarian bet by investing in AST Spacemobile, I recommend the following risk management strategy (exclusive to TQI Full Access):

To access this strategy, upgrade to The Quantamental Investor Full Access.

Final Thoughts

A lot will need to go right for ASTS to become a 100-bagger, but there's a realistic path here, and in my view, the chance of success is quite good given AST Spacemobile's proven tech, robust strategic partnerships, visionary leadership, and first mover advantage.

Key Takeaway: AST Spacemobile (ASTS) is officially TQI's Asymmetric Pick for March 2024, and it has been entered into our asymmetric ideas list at $3.15 per share.

As of 26th July 2024, TQI’s Asymmetric Ideas Series has grown to 16 Picks, with the average return for these ideas standing at roughly +55%. While past performance is no guarantee of future returns, nailing three 3-bagger [200%+ return] stocks in 16 months is a solid validation of our proprietary investing methodology.

If you’d like to start receiving TQI’s Asymmetric Ideas Series delivered right to your inbox every month, join TQI Tidbits paid now.

Once again, thank you for your continued readership. I’ll see you in the next one!