CrowdStrike Vs SentinelOne: 2 Cybersecurity Titans, No Winning Play

Fundamental, Quantitative, Valuation, and Technical Analysis

Introduction

Amidst a broad market decline, cybersecurity titans - CrowdStrike Holdings, Inc. (CRWD) and SentinelOne Inc. (S) - have suffered significant drawdowns over the past month.

Now, despite their architectural differences, both CrowdStrike's Falcon and SentinelOne's Singularity are leading cybersecurity platforms helping organizations protect against and respond to breaches.

With the advent of AI, the sophistication of cyberattacks is on the rise, and as such, the demand for AI-powered cybersecurity platform solutions remains robust. As such, the recent dip in this space could be a buying opportunity for long-term investors. While it is hard to separate the wheat from the chaff in the early phases of any technological transformation, we shall perform a comparative analysis on CrowdStrike and SentinelOne in this note to decipher the better stock to buy right now. Let's dive right in!

CrowdStrike Vs. SentinelOne: Which Stock Is The Better Buy?

In this exercise, we will compare CRWD and S stocks using fundamental, quant factor grade, technical, and valuation analysis.

Fundamental Analysis

As a starting point for this comparison, please note that CrowdStrike is roughly ~15x the size of SentinelOne by market capitalization.

Interestingly, CrowdStrike's TTM revenue is only ~5x that of SentinelOne, with the latter growing top-line at a slightly faster pace. Now, given CrowdStrike's July 19 incident, SentinelOne was [and is] widely expected to win market share from its rival. While SentinelOne's leadership highlighted an uptick in customer wins in their quarterly report last month, both companies are projected to grow sales at a similar pace [20-25%] in the current fiscal year. Henceforth, CrowdStrike seems to be holding its fort just fine.

On the margin front, CrowdStrike and SentinelOne have delivered tremendous expansion in recent years, with gross profit margins sitting in the mid-70s for both cybersecurity titans. That said, CrowdStrike is much further along in its margin optimization journey, as evidenced by operating and FCF margins:

As you can observe on the chart below, CrowdStrike is already a cash cow business [generating $1B+ FCF over the past 12 months at a +27% FCF margin]. In contrast, SentinelOne just turned free cash flow generative last year [+1% FCF margin in 2024].

Now, CrowdStrike became GAAP profitable in Q1 FY2024; however, in light of its July 19 incident, the company has experienced some margin pressures [mostly due to discounting] that have resulted in a flip back to GAAP losses.

On the other hand, SentinelOne remains years away from GAAP profitability, with GAAP net income margins sitting at -35% in 2024.

That said, both CrowdStrike and SentinelOne are well-capitalized businesses with net cash balances of $3.6B and $0.7B, respectively.

From a fundamental perspective, both CrowdStrike and SentinelOne appear to be heading in the right direction -> growing sales at a healthy clip [20%+ y/y] and improving cash flow generation.

Valuation Analysis

Now, optimizing profit and FCF margins whilst scaling up the business is a tricky challenge. Over the past five years, CrowdStrike delivered significant operating leverage to establish a concrete, profitable growth story. On the flip side, while SentinelOne's margin and bottom-line numbers are also trending in the right direction, SentinelOne has experienced considerable moderation in its growth rates in recent quarters as the company has pushed for margin optimization [chased FCF breakeven].

As such, Mr. Market is pricing CrowdStrike [~22.9x Price-to-Sales, ~18.9x forward Price-to-Sales] and SentinelOne [~7.2x Price-to-Sales, ~6.0x forward Price-to-Sales] quite differently - assigning a significant premium to CRWD:

On a relative basis, CrowdStrike is 3x more expensive than SentinelOne. While both companies are growing at a similar pace, CrowdStrike's FCF margins warrant a premium over SentinelOne. That said, individually, CrowdStrike's 20x+ P/S multiple is extremely rich for its current growth outlook, and SentinelOne's 7x P/S multiple may seem like a bargain to some.

To solve this quandary, let's look at the absolute valuation of CRWD and S.

Modeling points:

-> For both CrowdStrike and SentinelOne, I am using above-consensus CAGR sales growth of 25% for the 5-year modeling period.

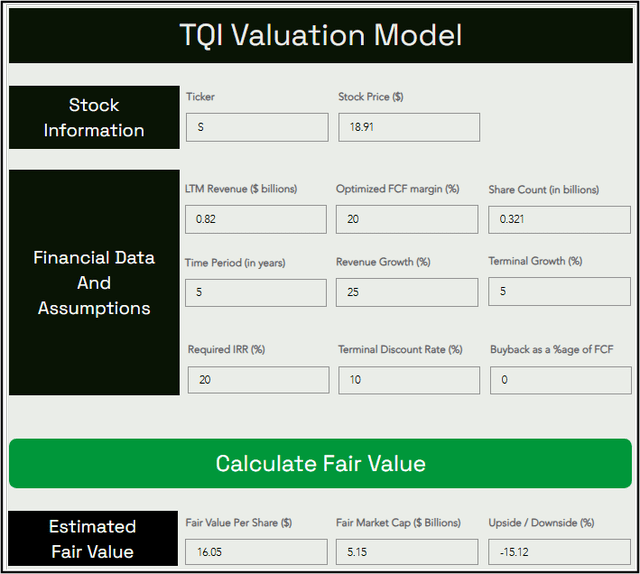

-> Like CrowdStrike, SentinelOne could end up commanding 30-40% FCF margins at maturity; however, over the next five years, I view 20% FCF margin as a more realistic margin optimization target.

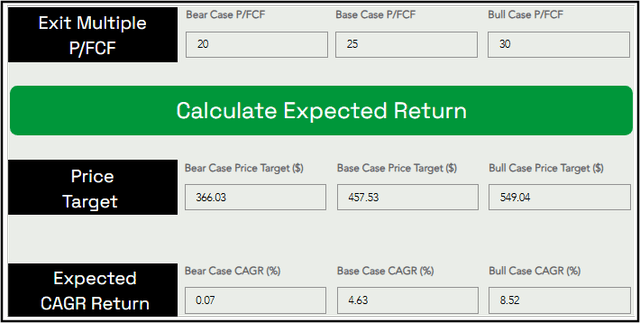

-> Given CrowdStrike's superior cash generation, we set the required IRR (discount rate) for CRWD at 15% and assigned a premium exit multiple of 25x P/FCF. For SentinelOne (operating at breakeven FCF), we are using a higher discount rate of 20% and assigning a more reasonable exit multiple of 20x.

All other assumptions are relatively straightforward, but if you have any questions, feel free to share them in the comments section below.

TQI's Valuation for CrowdStrike

TQI's Valuation for SentinelOne

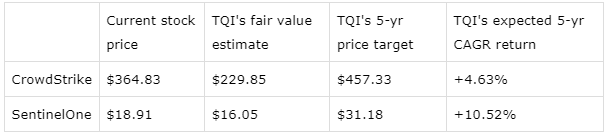

Summary of TQI's valuation for CrowdStrike and SentinelOne:

From a valuation standpoint, both CrowdStrike and SentinelOne are overvalued. While S stock has a downside of -15% to fair value, CRWD stock has a downside of -37%. With the 5-year expected CAGR returns of both SentinelOne and CrowdStrike falling short of TQI's investment hurdle rate of 15%, I am not buying any of these cybersecurity stocks right now.

Quant Factor Grade And Technical Analysis

According to Seeking Alpha's Quant Rating system, both CrowdStrike and SentinelOne are rated "Hold" with scores of 3.00/5 and 3.13/5, respectively.

For CrowdStrike, Valuation [D-] and (earning) Revisions [D] are offsetting positive grades for Growth [B+], Profitability [A], and (technical) Momentum [B+]; whereas for SentinelOne, (discounted relative) Valuation [A-] and Growth [A+] are making up for weakness in Profitability [C+], Momentum [D+], and Revisions [C-].

From a technical perspective, CrowdStrike's bullish momentum is still intact, with the stock still trading well above its uptrend line (marked with a black arrow on the chart below):

While CRWD's weekly RSI has rolled off from overbought levels, the ongoing pullback could extend down to the low-to-mid $200s -> re-testing the uptrend line connecting recent local bottoms and TQI's fair value for CrowdStrike. If CRWD gets this low, I would be a buyer.

On the other hand, SentinelOne is trading close to the lower end of a Stage-I accumulation base:

After an epic collapse in 2021-22, S stock has formed a base in the low-$10s to high-$20s range. Until a clear breakout or breakdown appears, I expect SentinelOne stock to continue this sideways rangebound action despite SentinelOne's weekly RSI reading closing in on "oversold" territory.

Concluding Thoughts

With both CrowdStrike and SentinelOne growing at a similar pace, I prefer CrowdStrike from a fundamental standpoint due to its greater scale and higher cash generation (optimized margins). Unfortunately, Mr. Market does too, with CRWD trading at a rich valuation of 20x+ P/S (~3x of SentinelOne's valuation multiple).

Based on our absolute valuation assessment, SentinelOne has a smaller downside risk to fair value, and a higher long-term reward potential. That said, none of CRWD and S meets TQI's investment hurdle rate of 15%. I guess we will just have to exercise more patience to get an attractive entry point.

Key Takeaway: I rate both CrowdStrike and SentinelOne "Neutral/Hold/Avoid" at current levels.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Good analysis! I love the idea of comparing two companies as opposed to just one.