Hims & Hers: Ephemeral Turbulence To Be Followed By A New Phase Of Profitable Growth

A free business update on one of my biggest winners

Introduction

Since initiating coverage on Hims & Hers, Inc. (HIMS) in May 2022 with a "Strong Buy" rating at ~$3.5 per share, I have published an additional 6 "Strong Buy" recommendations in recent years:

With Hims & Hers stock currently trading at ~$52 per share, HIMS has undoubtedly been one of my biggest winners! Today, we shall analyze Hims & Hers' Q1 2025 report, business outlook, valuation, technicals, and more.

How Did Hims & Hers Fare In Q1 2025?

With the Hims & Hers flywheel humming along in fine fashion, the emerging healthcare tech company delivered stunning numbers for Q1 2025:

Revenue: $586M [+111% y/y, vs. est. $539M]

Subscribers: 2.4M [+38% y/y]

Monthly Online Revenue Per Avg. Subscriber: $84 [+53% y/y]

On a segment level, Online Revenue rose +115% y/y to $576M, driven by strong subscriber uptake of its compounded semaglutide GLP-1 offerings [$230M, majority of which came from personalized doses] and healthy +30% y/y growth in non-GLP-1 sales, which came in at $346M.

In the 10-Q filing, Hims & Hers' leadership highlighted their Super Bowl Ad campaign as a major driver of increased traffic on the platform across web and mobile apps.

And, as per data from Bloomberg Second Measure LLC, Hims & Hers continues to garner a lion's share of total customers and sales across categories [Sexual Health, Dermatology, Mental Health, and Weight Loss] against its peer set:

Now, given robust unit economics, Hims & Hers' top-line scale up is resulting in operating leverage, with adj. EBITDA margins rising to +16% in Q1 2025 [up from 12% in Q1 2024] driven by strong Marketing and G&A leverage.

While aggressive reinvestments across the business limited Hims & Hers' free cash flow generation in Q1 2025 to ~$50M, quarterly operating cash flow reached new highs of $109M.

Overall, Hims & Hers' Q1 2025 report was mighty impressive. However, with commercial compounding of GLP-1s no longer possible, Hims & Hers' weight loss business is set to experience a painful transition in upcoming quarters.

What's Ahead?

Looking forward, Hims & Hers' management has guided for a first-ever sequential decline in revenues in Q2 2025, with revenue projected to come in at $530-550M [-6.5% to -9.5% q/q] - primarily due to product transition in its sexual health and weight loss business:

First, we expect continued strong growth across many of our most tenured offerings, including mental health as well as men's and women's dermatology, all of which are benefiting from years of investment in brand retention and personalized offerings. That said, while sequential and year-over-year growth is expected to continue, we do expect uneven trends in sexual health as we navigate transitions in the treatment mix, which we believe is temporary as new daily personalized solutions gain traction. We're already starting to see encouraging signs of momentum that we believe will strengthen with the addition of new offerings over the course of the year.

Second, we expect to complete the transition of subscribers previously on commercially available doses of semiglutide to either appropriate alternatives on our platform or other platforms entirely by the end of the second quarter. This transition is expected to result in a one-time quarter-over-quarter revenue drop in the second quarter, from which we are confident we can continue to build upon through the remainder of the year.

- Yemi Okupe, Hims & Hers' CFO on Q1 2025 Earnings Call (Transcript)

Now, while Hims & Hers' is clearly set to hit some turbulent waters this quarter, the business retrenchment is expected to be a temporary blip, with management re-affirming their full year revenue outlook of $2.3-2.4B for 2025, and lifting the adj. EBITDA guidance to $295-335M.

Interestingly, Hims & Hers' guide for Weight Loss revenue for 2025 is unchanged at $725M+. This means Hims & Hers' management believes that, in a relatively short period of time, the loss of commercial compounded semaglutide GLP-1 revenues will be offset by continued growth in its existing weight loss solutions [Personalized Semaglutide, Liraglutide (generic GLP-1 -> launched in March 2025), and Oral Weight Loss drugs] and new revenue stream created by the recent addition of Novo-Nordisk's Wegovy (branded GLP-1) on Hims & Hers' platform.

Now, in its relatively short operating history, Hims & Hers has demonstrated a consistent track record of execution - driven by the strength of its business model and operational excellence - delivering hypergrowth over the past several years.

Despite the heightened likelihood of near-term growth wobbles, Hims & Hers' is still just scratching the surface, given its humongous TAM opportunity. As of Q1 2025, Hims & Hers was serving 2.4M subscribers; however, multiple existing specialties addressed by Hims & Hers represent 80-100M+ potential consumers in the US alone.

Furthermore, new specialities and geographic expansion equate to huge room for long-term growth.

Now, back in 2022, Hims & Hers' leadership set out lofty revenue and adj. EBITDA goals of $1.2B+ and $100M+ for 2025. However, based on current guidance, Hims & Hers is set to deliver ~2x revenue and ~3x adj. EBITDA!!!

After obliterating their past medium-term guidance, Hims & Hers' management have now set another impressive long-term goal - calling for $6.5B+ revenue and $1.3B+ adj. EBITDA in FY2030:

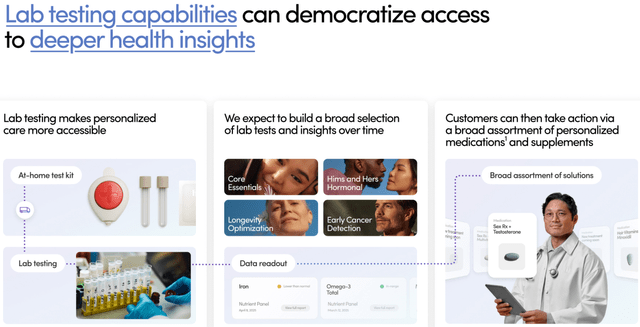

The long-term vision for Hims & Hers is to be synonymous with high-quality personalized care. By integrating diagnostics and leveraging artificial intelligence, Hims & Hers is aiming to elevate the subscriber experience on its platform, much like what Netflix (NFLX) has done over the past decade or so.

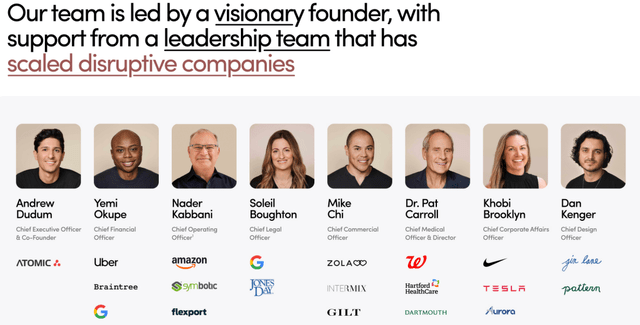

And, to accelerate global expansion and utilization of AI in healthcare, Hims & Hers has added two key C-suite executives to its leadership team and raised $870M at 0% interest via a convertible senior notes deal in the past week.

On 5th May 2025, Hims & Hers announced the appointment of 20-year Amazon veteran and global operations expert, Nader Kabbani, as its new Chief Operating Officer. And this high-profile pre-ER C-suite addition was followed up by the announcement of a new Chief Technology Officer, Mo Elshenawy, on 8th May 2025.

While GM's Cruise robotaxi shut down after a major incident amid piling operating losses, Elshenawy is a proven technology executive with deep expertise in artificial intelligence and large-scale infrastructure having led global engineering for Amazon's ReCommerce business and creation of retail data analytics platforms that powered over hundreds of millions in revenue in the past.

Thus far, Andrew Dudum has proven himself to be a true visionary founder and an excellent operator. And, given his track record, I trust his recruits and fully back his long-term vision for Hims & Hers.

In my mind, Hims & Hers remains a profitable growth story that has several years to run, with the platform on track to grow from 2.4M subscribers to 10-15M+ subscribers in coming years and lots of cross-selling potential across a loyal base!

With all of this information in mind, let us now re-evaluate HIMS' long-term risk/reward.

HIMS Fair Value And Expected Return

For today's valuation exercise, I am updating our model's revenue base to $2.5B [FY2025E] given greater confidence in Hims & Hers' full-year guide based on healthy non-GLP-1 sales growth in Q1 2025, addition of Novo's Wegovy (branded GLP-1) & Liraglutide (generic GLP-1) to a broadening weight loss offering, and expansion into new specialities [low testerone and menopause] in the back half of the year.

Now, Hims & Hers' 2030 revenue target floor of $6.5B implies ~22% CAGR sales growth over the 2026-2030 period. Given its execution history, Hims & Hers will likely outperform this long-term expectation. However, in order to be conservative with our model, I am baking in ~20% CAGR sales growth for the next five years.

On margins, Hims & Hers' long-term guidance is calling for adj. EBITDA margins of atleast 20% by 2030. However, with long-term gross margins likely to settle at 75-80%, I think Hims & Hers could do even better on the profit margin front when the business reaches steady-state terminal growth. Hence, I am sticking with our optimized FCF margin assumption of 35%.

Also, Hims & Hers' share buyback program has ~$65M remaining, but given its global ambitions and rapidly climbing share price, I believe management will recalibrate the capital allocation towards long-term growth. As such, I have taken the "Buyback as a %age of FCF" assumption down from 25% to 0%.

All other assumptions are straightforward, but if you have any questions, thoughts, and/or concerns, please share them in the comments below.

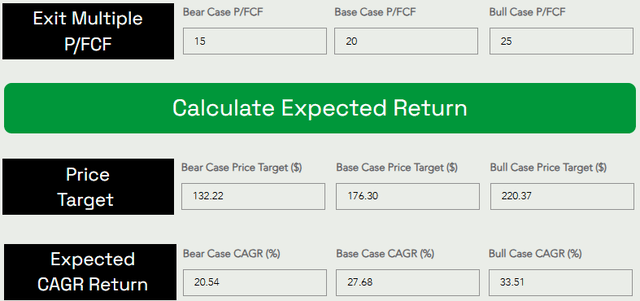

Here's my updated valuation model for Hims & Hers:

According to these results, Hims & Hers is worth $112.30 per share [up from $67.50 at the previous assessment].

Note: Kindly understand that this is a forward-looking model based on FY2025E numbers, i.e., the updated fair value estimate for Hims & Hers is an estimate for its intrinsic value at the end of 2025 [7-month forward].

Now, predicting where a stock will trade in the short term is impossible; however, over the long run, a stock will track its business fundamentals and obey the immutable laws of money. If the interest rates were to return to artificially low levels (i.e., ZIRP), higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x (P/FCF).

Assuming a conservative exit multiple of ~20x P/FCF, I can see Hims & Hers' stock trading at ~$176.3 per share in 2030:

With Hims & Hers' expected 5-year CAGR return handily exceeding our investment hurdle rate of 15%, HIMS stock remains a "Strong Buy" under our valuation process at current levels.

Concluding Thoughts

After several years of hypergrowth, Hims & Hers is set to experience its first-ever quarter of sequential revenue decline in Q2 2025 due to product transition within sexual health and end of commercial compounding of semaglutide GLP-1. However, this is just an ephemeral blip, with the healthcare tech platform company set for profitable growth through the rest of this decade and beyond - powered by greater TAM penetration within existing specialties, new specialties, global expansion, and integration of AI.

Back in February 2025, I wrote the following -

Technically, Hims & Hers' stock has now pulled back to its 10-week MA support at ~$37 per share, with weekly RSI moving out of "overbought" territory. While the ongoing drawdown may deepen to the 20-week MA [low-$30s] or 40-week MA [mid-$20s] support levels if broad market weakness persists in the near term, I think a combination of smoother-than-expected transition within Hims & Hers' GLP-1 business and reinvigoration of growth across Hims & Hers' non-GLP-1 business can stoke another powerful leg higher in HIMS stock over the next 12–24 months.

Source: Hims & Hers: Down 45% In 5 Days, Is The Stock Still A Buy?

Three months on, Hims & Hers has rebounded strongly off of the 40-week MA support in the mid-$20s, and is now trading into the $50s on the back of a 20%+ post-ER jump:

Volatility is inherent to early-stage growth stocks, and Hims & Hers is no different. With weekly RSI getting close to "Overbought" levels once again, HIMS stock may suffer a correction in the near-term, especially if the US economy were to slide into a recession. That said, Hims & Hers' long-term risk/reward remains favorable, and technical momentum is bullish. With >30% of HIMS float sold short right now, a massive squeeze into the triple digits cannot be ruled out.

Considering Hims & Hers' business fundamentals, humongous TAM (growth potential), stock undervaluation, and positive technicals, I continue to view HIMS stock as a "Strong Buy" right now.

Key Takeaway: I rate Hims & Hers stock a "Strong Buy" at ~$52 per share.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below.

Want More Asymmetric Investment Ideas?

To help supercharge our members' journey to financial freedom, we publish TQI's Asymmetric Ideas Series at TQI Tidbits, with each stock pick targeting +50-100% return in 1-3 years. Since its launch in April 2023, TQI’s Asymmetric Ideas Series has grown to 25 Picks, with the average return for these ideas standing at +75.4% as of writing on 11th May 2025.

If you’d like for TQI’s Asymmetric Ideas Series to be delivered right to your inbox every month, upgrade to a paid membership now.

It is 157% up YTD. What’s the fair value today / next 6 months?