Sea Limited: Resilience In The Face Of Adversity

Is the Southeast Asian tech giant still a buy? Read our latest free note to find out!

Introduction

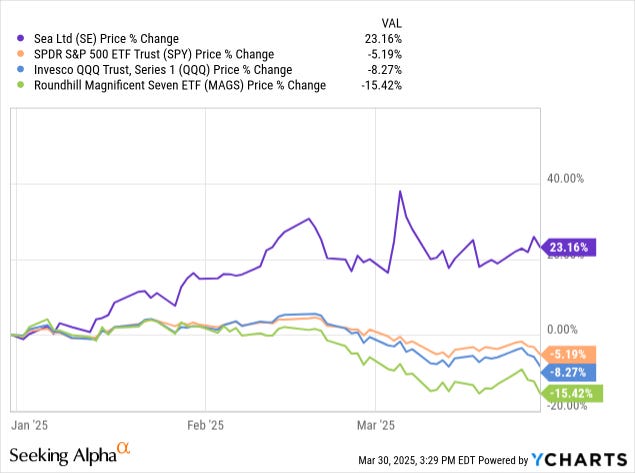

The US stock market has hit rough waters in 2025, with broad equity indices sliding into correction territory. However, international markets such as Europe and China have fared quite well, with Southeast Asian tech conglomerate, Sea Limited (SE), adding >20% to its market capitalization year-to-date on the back of a significant run-up last year!

While attributing SE's resilience to investors/traders scraping for geographical diversification is easy, I believe Sea's business turnaround is fueling these continued gains. At our investing group, The Quantamental Investor, we are holding a long position in SE [~1.33% of TQI's Moonshot Growth Portfolio AUM] acquired at an effective cost basis of $52.35 per share over 2022-24:

Today, we shall review Sea's business performance, re-evaluate its long-term risk/reward using TQI's Valuation Model, and analyze its technical chart.

Sea Limited: By The Numbers

After experiencing a transitional year in 2023, Sea Limited delivered an exceptional business turnaround in 2024, with revenue growth re-accelerating back up to ~36.9% y/y last quarter:

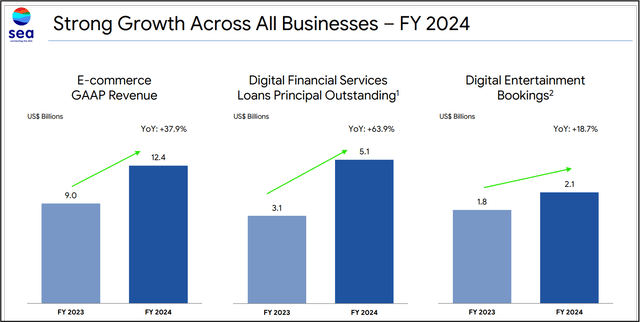

While FreeFire's redemption arc (powered by explosive growth in Africa) aiding a return to positive growth within Garena [Digital Entertainment] was a big piece of the turnaround, robust growth across Shopee [E-commerce] and Sea Money [Digital Financial Services] has elevated Sea to new heights.

As per Sea's Chairman and Chief Executive Officer, Forrest Li -

E-commerce [Shopee]: GMV grew 28% year-on-year to surpass US$100 billion, and we achieved adjusted EBITDA profitability in both Asia and Brazil. We remain confident about our ability to continue delivering profitable growth in 2025 and expect Shopee’s full-year 2025 GMV growth to be around 20%, with improving profitability.

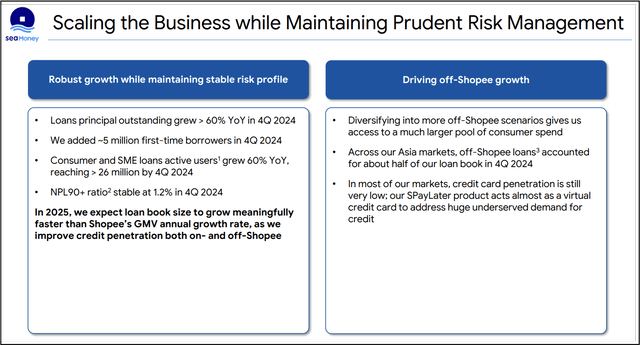

Digital Financial Services [Sea Money]: We delivered exceptional loan book growth of more than 60% year-on-year in the fourth quarter, surpassing US$5 billion as of the end of 2024, making us one of the largest consumer lending businesses in Southeast Asia. While we have scaled fast, risk management remains to be our top operational priority. In 2025, we expect loan book size to grow meaningfully faster than Shopee’s GMV annual growth rate, as we improve credit penetration both on- and off-Shopee.

Digital Entertainment [Garena]: 2024 was a great year for Garena, marking Free Fire’s remarkable comeback with annual bookings growing at 34% year-on-year. Looking ahead into 2025, we will continue scaling our user base and broadening our content offerings. We now expect Garena to grow double-digit year-on-year, for both user base and bookings in 2025.

Source: Sea Limited Investor Relations

Now, in addition to all three of Sea's businesses exceeding management's original sales guidance by delivering strong, double-digit growth, 2024 turned out to be the second consecutive year of annual positive net income for Sea, with all three businesses recording positive adjusted EBITDA.

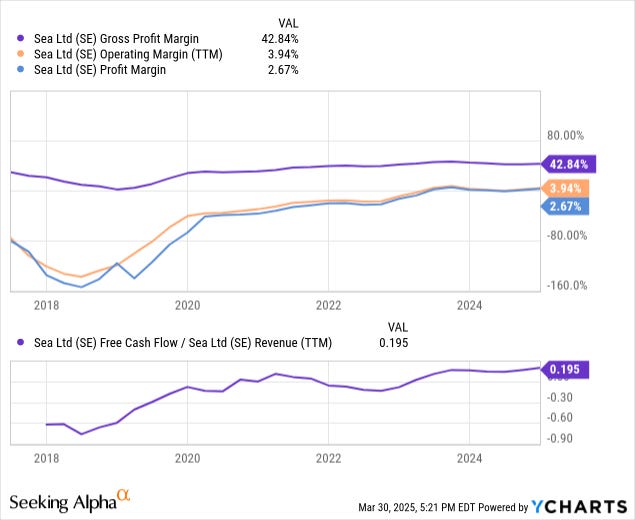

While Sea's gross margins have moderated to the low-40s, greater scale and operational efficiencies are leading operating, FCF, and net margins higher!

In fact, over the past twelve months, Sea has generated $3.28B in free cash flow [TTM FCF margin: +19.5%] - proving its chops as an emerging free cash flow machine:

And, with such explosive growth in FCF, Sea's balance sheet is improving rapidly - cash position going up, debt going down -> resulting in net cash balance of +$5.6B as of the end of Q4 2024.

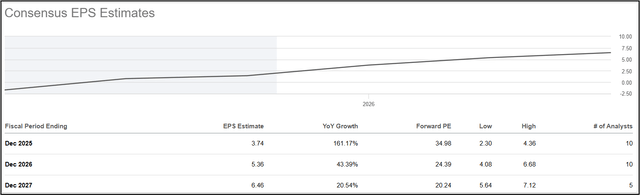

Looking forward, the Southeast Asian tech giant appears to be an enticing profitable growth story, with healthy, double-digit revenue growth projected to be accompanied by explosive earnings growth:

With all of this information in mind, let's re-evaluate SE's long-term risk/reward using TQI's Valuation Model.

SE Stock Fair Value And Expected Return

For today's exercise, I have updated Sea's revenue base to $16.8B [FY2024 revenue], and lifted our modeling-period growth assumption from 10% to 15% due to robust momentum across the business and positive business outlook for FY2025.

Now, on the margin front, Sea is justifying our past optimized FCF margin assumption of 20%. While the business could very well end up doing ~25-30% FCF margin at maturity (terminal growth), I am modeling 20% for now to maintain a margin of safety.

All other assumptions have been held constant from our last assessment and are self-explanatory, but if you have any questions, please share them in the comments section below.

As per our model, TQI's fair value estimate for SE stock stands at $143 per share [$87.36B in market cap], which reflects a near-term upside potential of ~10% from current levels.

Now, predicting where a stock will trade in the short term is impossible; however, over the long run, a stock will track its business fundamentals and obey the immutable laws of money. If the interest rates were to return to artificially low levels (i.e., ZIRP), higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x (P/FCF).

Assuming an exit multiple of ~20x P/FCF for 2029, I can see SE stock trading at ~$221 per share five years from now. This price target implies a 5-year CAGR return of +11.25%.

While I appreciate Sea's business turnaround and believe in its long-term potential, SE's 5-year expected CAGR return falls short of our investment hurdle rate of 15%. As such, I now rate SE stock a "Hold" at current levels.

Final Thoughts

From a business standpoint, Sea Limited is firing on all cylinders, with Shopee, Sea Money, and Garena growing at a healthy clip whilst improving profitability. Unfortunately, on the back of a stellar run-up in SE stock, its 5-year expected CAGR return has slipped under our investment hurdle rate. Given our rules-based approach, we cannot justify fresh capital allocation in SE stock here.

Now, from a technical perspective, SE stock appears to have broken out of a long Stage-I accumulation base into a Stage-II ascent:

According to Stage Analysis, assets tend to experience sharp upward price moves during Stage-II:

Hence, despite treading close to "overbought" [RSI > 70] territory, SE stock could continue to march higher in upcoming weeks and months. That said, SE stock is yet to re-test the breakout of the accumulation base at ~$90-100 per share. Such a re-test may or may not materialize, but if we do see a reversal in SE down to those levels, and a successful hold there, I will turn into a buyer.

Key Takeaway: I rate SE stock a "Hold" at $130 per share.

Thanks for reading, and happy investing! Please share your thoughts, questions, or concerns in the comments section below.