Introduction

After initiating coverage on Super Micro Computer (SMCI) stock with a "Hold/Neutral" rating at ~$960 per share in June, I upgraded SMCI to a "Buy" rating in the low-to-mid-$500s in early August - terming it a "falling knife worth catching":

Super Micro's Q4 FY2024 report is a mixed bag, with a wafer-thin beat on revenues getting gazumped by a significant miss on EPS estimates. While SMCI's gross and operating margin compression raises concern around Super Micro's value-add and pricing power, the revenue outlook for FY2025 is mind-blowing - with net sales projected to come in at $26-30B [well ahead of pre-earnings consensus estimates of $23B]. Based on our analysis, Super Micro's long-term risk/reward has improved significantly in light of its pullback into the mid-$500s.

Technically, SMCI stock appears to be a falling knife, having sliced through its 200-DMA support with ease. While the drawdown could get deeper in the near future, SMCI stock is getting close to "oversold" territory. Based on business fundamentals, near-term outlook, and reasonable valuation, I think Super Micro is a falling knife worth catching for long-term investors looking to participate in the AI Infrastructure theme. That said, I strongly prefer slow, staggered buying over a lump sum purchase.

Key Takeaway: I rate Super Micro Computer, Inc. a "Buy" in the ~$500s, with a strong preference for slow, staggered buying over 6-12 months.

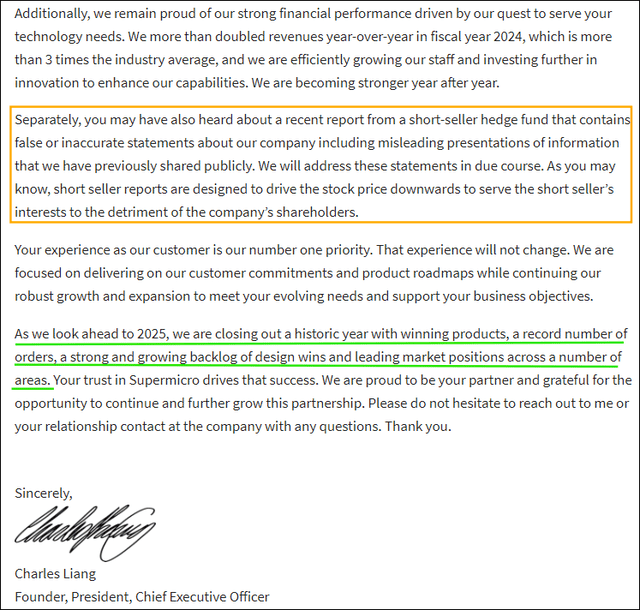

Now, it's only been a couple of months, but owning Supermicro has been an absolute nightmare! First, activist short-seller - Hindenburg Research - posted a scathing report on Supermicro that alleged accounting malpractices. Then, Supermicro failed to file its 10-K annual report in a timely manner:

Super Micro Computer, Inc. (the “Company”) is unable to file its Annual Report on Form 10-K for the period ended June 30, 2024 (the “2024 Form 10-K”) in a timely manner without unreasonable effort or expense. In response to information that was brought to the attention of the Audit Committee of the Company’s Board of Directors, the Board of Directors has formed a committee to review certain of the Company’s internal controls and other matters (the “Review”). The Review is ongoing and all parties are working diligently to complete the Review. Additional time is also needed for the Company’s management to complete its assessment of the effectiveness of its internal controls over financial reporting as of June 30, 2024. Based upon the work done to date, the Company does not anticipate the 2024 Form 10-K will contain any material changes to its results for the fiscal year and quarter ended June 30, 2024 that were announced in the Company’s press release dated August 6, 2024.

In response to these events, I suspended my slow, staggered accumulation of Supermicro shares, as noted here -

Since then, Supermicro has received a non-compliance letter from Nasdaq that could lead to a de-listing in the next two to eight months if the server company fails to regain compliance by filing its 10-K report.

And then, last Thursday, WSJ reported a US DOJ probe on Supermicro's alleged accounting violations - sending SMCI stock tumbling by over 15%, flipping near-term technical momentum back to bearish!

In today's note, we shall examine Supermicro's updated long-term risk/reward and assess the curious case of its missing 10-K report to formulate an informed investment decision.

Based On The Information At Hand, SMCI Stock Is Looking Quite Attractive

According to Supermicro's leadership, no material changes to Q4 or FY2024 results are expected from its ongoing internal review of accounting practices and financial controls.

Taking Supermicro's FY2024 results and FY2025 guidance at face value, I estimate SMCI's fair value to be $802 per share or ~$51.5B in market cap:

For this valuation exercise, I used a revenue base of $14.9B [FY2024 revenue]. Further, given SMCI's outlook for 74-101% y/y revenue growth to $26-30B, I am sticking with my 5-year CAGR sales growth rate assumption of 30%. On the margin front, I have said that Super Micro's gross margin of ~10-15% reflects its limited value-add and/or constrained pricing power as a plug-and-play server provider, and I maintain this stance. While Super Micro's management is optimistic about driving margins higher over the long run, operating margins slipping to ~7.8% level in Q4 was worrisome, and as such, I assumed a steady-state optimized FCF margin of 7.5%.

All other model assumptions are pretty straightforward, but please share any questions that you may have in the comments section below.

Now, assuming an exit multiple of 20x P/FCF, I can see SMCI stock rising to ~$1292 per share over the next five years at a CAGR rate of ~25%.

In light of its downshift from the low $500s to the low $400s, SMCI's 5-year expected CAGR return has shot up from ~19% to ~25%. Hence, if Supermicro's financial results and forward guidance are genuine, SMCI is a fantastic buy right now.

However, with Supermicro's 10-K still missing - a month after the original deadline, trusting Supermicro's recent financial results and business outlook could be a fatal mistake for investors -> like Enron Corporation from back in the day!

Fool Me Once, Shame On You; Fool Me Twice, Shame On Me

Now, if Super Micro Computer did not have a chequered past, I would have ignored the short-seller report from Hindenburg, which is full of allegations but short on substantive proof of fraud. However, as you may know, Supermicro failed to file its 10-K report in August 2017 and got delisted from the Nasdaq in 2018. While the company managed to relist on Nasdaq in January 2020, it was fined $17.5M by the SEC for accounting violations, including improperly recognizing revenue and understating expenses.

Artificial Intelligence remains a red-hot theme; however, the AI server market is extremely competitive [as evidenced by Supermicro's margin performance], and I wouldn't put channel stuffing beyond Liang & Co. In recent quarters, Supermicro's cash flows have turned negative, and Supermicro delaying its 10-K raises severe doubts about the short-seller's accounting violation claims.

Yes, the law says - innocent until proven guilty. However, Supermicro has committed accounting shenanigans in the past, and could be doing so again, given the US DOJ has reportedly opened a new probe on the company.

Concluding Thoughts

With the AI infrastructure spending boom likely to continue in 2025 [based on guidance from industry stalwarts such as Nvidia (NVDA) and Micron (MU)], Supermicro is undoubtedly an enticing play - especially due to its attractive valuation. After all, SMCI stock could generate ~25% CAGR returns over the next five years "if" its financial results and forward guidance are genuine.

Now, I am not a forensic accounting expert, but until Supermicro files its 10-K, SMCI is an untouchable stock. We wouldn't want to be caught napping if an accounting scandal is being uncovered. Hence, I am moving to the sidelines and waiting for the dust to settle. In this instance, the onus is on Supermicro to prove its innocence, given its chequered past.

Key Takeaway: I am downgrading Supermicro to a "Neutral" rating.

Thank you for reading, and happy investing! If you have any questions, thoughts, and/or concerns, please feel free to share them in the comments section below.