TQI Weekly - Issue #10: Welcome 2023! What's Next, An Epic Rebound Or A Painful Crash?

Hello, and welcome to the 10th issue of The Quantamental Investor’s Weekly Newsletter series.

This newsletter will bring you up to speed on weekly market action, provide you with new investment ideas & research, and share portfolio strategies & investing best practices to help you build a robust investing operation.

Please feel free to share feedback with me at "the.quantamental.investor@gmail.com".

Market Round-Up: Both Santa And Grinch Went Missing From Wall Street Last Week

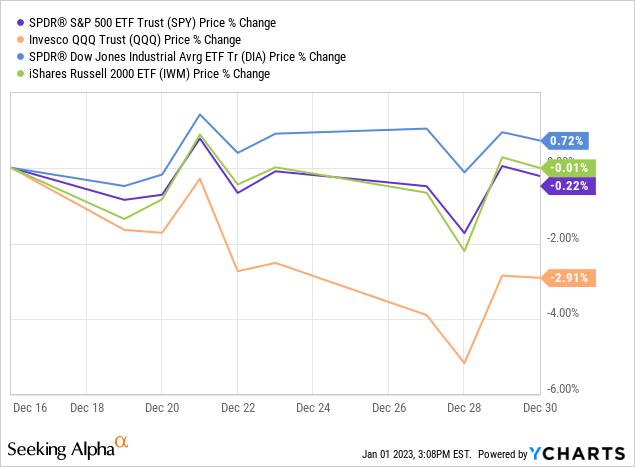

While the first half of December was ugly for equity markets, the second half turned out to be pleasantly uneventful! On an index level, performance over the last couple of weeks was quite mixed - S&P500 (SPY) went up by +0.7%, Dow Jones Industrial Avg (DIA) & Russell 2000 (IWM) were roughly flat, and Nasdaq100 (QQQ) were down ~3%.

The weakness in technology (especially mega-cap tech) stocks was a major driver of the relative underperformance seen in QQQ. And, in my view, the pain for tech stocks is far from over, with generals like Apple and Microsoft still trading at premium valuations. The likelihood of a recession is rising, and tech stocks (along with broader equity markets) could continue to remain under pressure in 2023.

As I see it, there are select opportunities in the tech sector that are well worth buying right now, and we will continue to accumulate equities across our core portfolios throughout the next six to twelve months. In my view, individual stock investing with dollar-cost averaging plans combined with proactive risk management is the best way to operate in this bear market.

So, how are we doing so far?

Here's a performance snapshot of TQI's core portfolios since inception on 2nd September 2022:

At TQI, we cater to five different investment mandates, as shared below:

Source: Building A Robust Investing Operation With TQI

As you may already know, our growth-oriented strategies haven't fared well over the course of the last four months, with TQI's GARP and Moonshot Growth strategies each returning -11% so far. To add some context, the benchmark for these high beta strategies, i.e., QQQ, is down -10% over the same period. While I am extremely unhappy with the absolute performance of our growth-oriented strategies, I think we need to maintain a long-term view [3, 5, and 10+ years] and continue accumulating our high-conviction ideas within these portfolios.

On an absolute basis, TQI's Buyback-Dividend portfolio closed the year slightly in the red with a return-to-date performance of -1.65% (measured from inception date: 09/02/2022). Compared to its benchmark, i.e., S&P 500 (SPY), TQI's Buyback-Dividend portfolio is outperforming by +0.85% (as of the market close on 12/30/2022). In my view, this strategy is performing exceptionally well in a challenging market and continues to prove the efficacy of financial engineering in equity markets.

Now, operating in a bear market as long-term focused investors is hard, and yet it is something we must keep doing to achieve our financial objectives. Remember, big returns are made during bear markets; we just realize that much later!

At TQI, We Are Positioned Defensively For 2023

With the Fed tightening aggressively into a deeply inverted yield curve, a richly valued equity market faces the double whammy of a multiple contraction and an earnings recession in 2023. While we can't predict interest rates and FED's policy decisions, we can control our investment portfolios.

Here's my outlook for this hostile market:

An asset's PE (price-to-earnings) ratio is directly governed by the risk-free rate in the market. So if the FED moves risk-free rate to say 5%+ [terminal rate] and holds it there for a while, the market could end up demanding an earnings yield of 7-9% from equities (risk premium of 2-3%). Invert that and we get a PE ratio of ~11.11-14.28x.

Historically, bear markets have bottomed with S&P500 (SPX) hitting the ~10-15x PE range. For 2022, S&P500 EPS is projected to come in at $225 based on consensus analyst estimates. In a typical recession, EPS tends to go down by 15-20%, and so, 2023 S&P500 EPS could land at $180 to $191.25.

Assigning a 10-15x PE ratio, we are looking at a potential bottom for the ongoing bear market in the S&P500 to be in the range of 1,800 to 2,868, which points to a decline of ~25-50% from current levels (SPX is at 3,839).

In late 2023, SPX's chart flashed a bearish technical crossover (MA-50 falling below MA-100 on the weekly chart) that has previously preceeded ~50% declines in broad market indices during the Great Financial Crisis and the Dot Com Bubble bust. If the S&P 500 plunges 35-50% from here, we get a range of 1,885 to 2,450.

The fundamental and technical views on a potential bottom for the S&P 500 are in alignment, and while this may sound scary, it is certainly a possible outcome of this bear market.

Source: Must Read - Exclusive: Bi-Weekly Portfolio & Market Update - November 4th, 2022

With the FED pulling liquidity out of the market and leading economic indicators flashing signs of an impending recession (a view supported by the bond market - an inverted treasury yield curve), we need to be defensively positioned. Such an environment is ripe for a financial accident, and we have put tactical option-based hedges in place to guard against a potential 25-50% decline in equity markets.

That said, equity markets rarely have back-to-back negative return years. Inflation is collapsing, and the FED may have wriggle room to loosen its monetary policy in 2023. If consumer demand stays resilient, we may see an epic rebound in the stock market. This is why our positioning is quite balanced.

We own high-beta names across our core portfolios, and I believe that even a 50% equity exposure should be enough to generate our target returns. On the flip side, we have tons of cash and tactical hedges to defend our portfolios against a continuation of the ongoing bear market.

With our balanced positioning, I feel confident that we are well-positioned to deal with whatever the market throws at us over the next few quarters. Throughout the bear market in 2022, we have seen tons of measured selling, and the latest bear market rally fizzled out (to the dot) at the trendline resistance.

We resumed the accumulation of equities in mid-December, and I am hoping to pounce on fresh buying opportunities in the upcoming weeks and months through our updated DCA strategy. We have a solid plan in place for navigating this exceptionally challenging bear market, and we will stick to this plan!

What's Ahead...

January 6, 2023 (Friday): The December jobs report is expected to show 57K nonfarm payroll additions, with average hourly earnings growth forecasted to slow to a pace of +4.9% Y/Y from +5.1% Y/Y in November. Furthermore, the unemployment rate is projected to remain steady at 3.7%.

All week: Tesla’s (TSLA) disappointing delivery numbers for Q4 (405K vs. est. 425K) could lead to significant volatility in TSLA 0.00%↑ and other EV stocks throughout this week.

TQI's Latest Research

We find ourselves in a bear market, but that doesn't mean we stop researching for opportunities to make money. Over the last week, we published three research notes, and here's a summary for your perusal:

1) Amazon Stock: Mr. Market's Christmas Gift For Patient, Long-Term Investors

Amazon's stock lost more than half its value in 2022, and it has now produced zero returns over the last four years! In this note, I analyzed Amazon on a multitude of factors, including the nature of its business, financial performance (current and projections), valuations (relative and absolute), and technicals. Despite near-term macro headwinds likely to persist in 2023, I like the risk/reward on offer at these levels. Hence, I rate Amazon a strong buy at $83 per share.

You can access the detailed article at Amazon Stock: Mr. Market's Christmas Gift For Patient, Long-Term Investors

2)Tesla Stock: An Asymmetric Buying Opportunity Arises Out Of Insider Selling, Demand Concerns, And A Scary Recession Playbook

Tesla is accelerating the world's transition to sustainable energy; however, this growth story could be about to hit a snag in 2023. In this note, I discussed the drivers of the ongoing capitulation in Tesla's stock and reasoned a potential path forward for it. Lastly, I shared my valuation and investment strategy for Tesla. I rate Tesla a "Strong Buy" in the low $100s, with a strong preference for staggered accumulation over 6-12 months due to high downside risk.

You can access the detailed article at Tesla Stock: An Asymmetric Buying Opportunity Arises Out Of Insider Selling, Demand Concerns, And A Scary Recession Playbook.

3) Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round 5

Treasury bonds are moving all over the place, with 10-year Treasury bond yield now sneaking back up to 3.88% last week after dropping below 3.5% for a brief period in December. On the other hand, the two-year Treasury yield is now lower than the Effective Federal funds rate. Overall, the Treasury yield curve is still deeply inverted, indicating an imminent recession. Post a stunning rally from mid-October to late November; equity markets have been declining since the Fed's FOMC meeting in December.

Apple has broken a key support level at June lows, and selling pressure could intensify from here. Technically, Microsoft is looking weak too. I continue to prefer short-duration bonds to park my cash (earmarked for future equity purchases). Additionally, I rate Apple and Microsoft "Neutral/Avoid/Hold" at current levels

You can access the detailed article at Apple Vs. Microsoft Vs. Treasury Bonds: The Battle Of Safe Havens Round 5.

4) Bi-Weekly Portfolio & Market Update

In a TQI Exclusive (pay-walled) report, I shared our market outlook and portfolio updates with TQI's marketplace subscribers. Find my detailed outlook for 2023 and our investment strategy for navigating this challenging market at The Quantamental Investor.

Investing Best Practice Tip

Before you go, take this piece of investing wisdom from Peter Lynch (one of the greatest mutual fund managers of all time) and internalize it. Peter famously said that -

In this business (investing), you’re right six times out of ten. You are never going to be right nine times out of ten.

Whether you are investing in individual stocks or index funds, losses are bound to happen. However, losses do not mean that you are a bad investor. As long as you are investing within the guardrails of your target returns and risk tolerance levels, with proper due diligence (equity research) and a long enough investment timeframe, you will easily get 6 out of 10 right, i.e., do well in the stock market!

Final Thoughts

Honestly, I don't know where the market is going next; nobody does. At TQI, we pursue bold, active investing with proactive risk management. After a painful 2022, we may or may not see a stock market crash or recovery this year, but whatever the market does, we are prepared, and our portfolios are positioned to win in 2023.

If you want access to TQI's exclusive research and portfolio strategies, please consider joining The Quantamental Investor.

I hope you enjoyed reading this edition.

Also, if you have any questions, thoughts, and/or

concerns, please share them in the comments section.

Thank you for reading. See you next time!