TQI Weekly - Issue #7: Markets Re-testing June Lows, Basics Of GARP Investing, and A Merger Arbitrage Trade Idea

Hello and welcome back to TQI's Weekly Newsletter series. In today's note, we will discuss the state of markets, an investing style, and a merger arbitrage idea.

The summer rally now seems like a distant memory; however, in mid-August people were talking about new all-time highs for the stock market. At the time, QQQ was trading at around 330-335 (up from June lows of 270), and in TQI Weekly - Issue #5: A New Bull Market Or Just Another Bear Market Rally?, we concluded that the rally was likely to be a bear market rally due to fundamental and technical factors. Unfortunately, my bearish take has proven to be prescient. As long-term investors, this unwind in equities is painful for all of us, but we must continue to invest more during this period of heightened volatility. After all, history shows that great fortunes are built in bear markets.

At its recently concluded FOMC meeting, the FED hiked the federal funds rate by 75 bps to a range of 3-3.25%, and Jerome Powell guided for another 100-125 bps hike over the next two meetings (by the end of 2022). The dot plot is now indicating interest rates rising as high as 4.9% in 2023, and FED Chair said they are willing to do more if required. Globally, most central banks are tightening their monetary policies to reign in the inflation genie, and while we are seeing signs of cooling in forward-inflation data, the threat of FED sleepwalking the economy into a deep recession is taking over investor psyche.

So far, we have seen a normalization in trading multiples with Nasdaq-100's P/E declining from 36x in 2021 to ~22x now. And while there may be some more room for compression here, the real fear in my mind is an earnings recession!

Technically, we are currently re-testing June lows, and while some market analysts believe that this may be the bottom, I am seeing market generals such as Microsoft (MSFT), Google (GOOG), and Meta (META) breaking below their June lows, and this price action tells me that we may have more pain to follow on the index (market) level. In October, Q3 earnings start rolling in, and if we see weak results and guidance cuts due to a tough macro environment, the P/E ratios will rise once again as 'E' (earnings) declines, and consequently, stock prices will need to move lower. In my mind, the next leg lower could be driven by an earnings recession, which is looking very likely due to stagflationary economic conditions and the FED's quantitative tightening program increasing cost of credit and hurting consumer demand.

While I don't know how low the market will go, or if it will go lower at all, if we do see a breach of June lows, technicals point toward a test of pre-pandemic highs in the 230-240 range for the QQQ. Let's see how the re-test of the market's June lows proceeds over the next few weeks. All we can do is stay safe, build long positions slowly, and manage risk proactively.

That's it for the status update on markets; now, let's explore an investing style.

Basics Of GARP Investing

GARP [Growth-At-A-Reasonable-Price] is an investing style that brings together the notion of growth and value investing under one roof. This style of investing is highly suitable for investors in the 'Accumulation' stage of their investor lifecycle; however, it can be utilized ubiquitously depending on an individual's goals and risk tolerance.

For me, GARP/Value investing is all about finding proven businesses with consistent fundamental growth, solid financial strength, and strong future earnings power - trading "at or below" their intrinsic value.

Under this style of investing, we want to buy wonderful companies at a fair price.

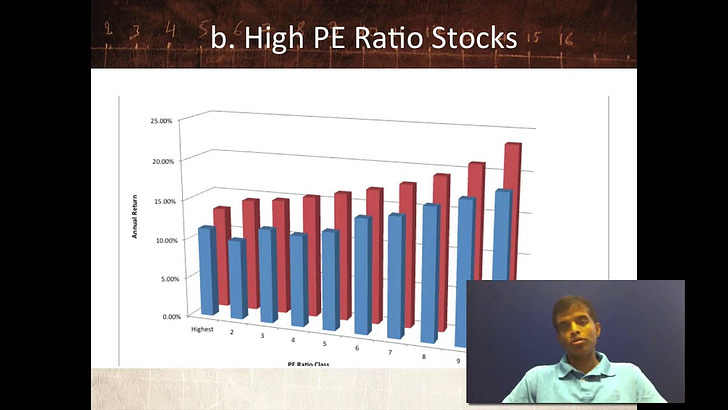

How to find/screen for GARP stocks? Let's learn about different methods for doing so from Mr. Aswath Damodaran, Professor at NYU Stern School of Business:

At my SA marketplace service - The Quantamental Investor - I share five model portfolios that are designed to serve investor needs across different stages of the investor lifecycle. Here's a list of our investment mandates:

TQI's GARP portfolio is a highly-concentrated, actively managed portfolio of best-in-class companies trading at or below their fair values with robust future growth potential. This portfolio strategy is most suitable for investors in the "Accumulation" stage of their investor lifecycle curve; however, individuals across different lifecycle stages can choose to adopt it if their investing goals and risk tolerance levels align with the ranges shared below:

How is TQI's GARP portfolio managed?

As I said earlier, our GARP portfolio is actively-managed. A deep study of historical business fundamentals and future outlook combined with quantitative and technical data analysis guides our stock selection process. And a company's valuation (intrinsic value and expected future returns) dictates its inclusion in our portfolio and the extent thereof (portfolio weight).

To understand TQI's stock valuation methodology, head over to this note: How to Value A Stock?

Furthermore, if you wish to evaluate any stock's valuation, feel free to use the TQI Valuation Model.

The decision tree shared below is pretty straightforward, but let me explain the decision nodes. Within TQI's GARP portfolio, we are targeting annual returns of 15-20%, and while not all investments will perform symmetrically, we set our hurdle rate for investment at the lower end of the target range, i.e., 15%. Hence, if a stock is trading at or below fair value and is currently offering 5-yr returns greater than or equal to 15%, the stock is buyable. Now, the capital allocation (and rebalancing activity) must still be governed according to suggested portfolio weights.

The decision rule for a 'Sell' rating is set at "Stock being Overvalued and Expected Return <= 10%" because this is the rate of return you could expect from an index fund tracking the market, i.e., the S&P-500 (SPY). If an individual stock is likely to make us less money than the market, we are better off buying the market. Summary table for stock ratings in TQI's GARP portfolio:

Due to this portfolio being exclusive to my marketplace service, I won't be able to share a lot of details here, but let's talk a little bit about the makeup of TQI's GARP portfolio:

While TQI's GARP portfolio is tech-heavy, it is well-diversified by end markets (industries/consumers). In the 21st century, technology is ubiquitous, and we are betting on technology's ability to transform various industries and sectors. The margins and scale tech companies can deliver are simply unparalleled, which is why we rely on them to participate in different end markets.

Roughly ~55% of TQI's GARP portfolio is in stable, less volatile, slower-growth, value-oriented stocks. The rest of this portfolio is allocated to a collection of rapidly-growing industry disruptors that can supercharge portfolio returns and help us achieve our long-term investing goals. As of 19th September 2022, the tech-heavy QQQ ETF is down ~27% YTD. It is fair to say that we are in a vicious bear market, and considering index-level valuations; I think we may have another 20-25% to go here. During this period of heightened uncertainty, I like the idea of deploying cash using a long DCA [dollar cost averaging] or systematic investing plan. For TQI's GARP portfolio, we started by deploying 50% of our $100K AUM at inception (2nd September 2022), and we will be deploying our cash at the rate of ~5% ($5K) per month going forward (once every two weeks). Also, we will be adding 2% [$2K] of starting AUM [$100K] as additional cash to the portfolio each month. With TQI's GARP portfolio, we have a long-term investment horizon (3-5+ years) and a stomach for volatility.

I guess that's all I wanted to share on GARP investing and TQI's approach to GARP investing. Before you go, I have a short-term trade idea for you.

A Special Merger Arbitrage Play

In one of my recent research notes, Microsoft: Insider Selling, Frothy Valuation, Worsening Fundamentals, And More, I showcased why Microsoft's stock was unattractive at $250 per share. While Microsoft's single-digit expected returns are unattractive to most investors, I have identified an indirect way to play Microsoft by buying Activision Blizzard (ATVI), a gaming studio set to be acquired by Microsoft in a $68.7B deal.

Doubts around regulatory approval for the deal have resulted in a fantastic merger arbitrage opportunity. Activision's buyout price is $95 per share, and the stock is currently trading at $75, which implies a merger arbitrage of ~27%. In my view, the likelihood of the MSFT-ATVI deal going through is pretty high, and Microsoft's management is confident about closing this acquisition by June 2023. If you're looking to make a tactical bet for 9-12 months, buying ATVI at $75 could be a smart move (handsome returns, little volatility in a bear market). For those open to long-short ideas, going long ATVI and short MSFT is a fine idea too (but maintaining a stop loss in accordance with your risk tolerance is imperative).

Final thoughts

Only the market knows where it is going next! We can only guess, and looking at several key stocks breaking down below their June lows, my guess is that we are headed lower on the index level too. We are operating in a bear market environment with FED's actions dominating the investor psyche. There are fantastic investment opportunities in individual stocks, and we will stick with TQI's playbook - "Build long positions slowly and manage risk proactively".

In today's note, we discussed GARP investing and TQI's approach to GARP investing. If you would like to replicate my model portfolio for this investing style, please consider joining The Quantamental Investor.

Thank you so much for reading this note. Subscribe to my newsletter to receive the next issue of TQI Weekly delivered directly to your email. See you next time!