TQI Weekly - Issue #9: Christmas Is Almost Here, So What Is It, Santa or Grinch?

Hello, and welcome to the 9th issue of The Quantamental Investor’s Weekly Newsletter series.

This newsletter will bring you up to speed on weekly market action, provide you with new investment ideas & research, and share portfolio strategies & investing best practices to help you build a robust investing operation.

Please feel free to share feedback with me at "the.quantamental.investor@gmail.com".

Weekly Market Round-Up

This week’s inflation data provided a positive surprise to the downside, with CPI coming in at 7.1% y/y vs. est. of 7.3% y/y. And the market was looking to rally higher earlier in the week; however, the FED played spoil-sport with its decision to raise federal funds rate by another 50 bps to 4.25-4.5% and to keep its $95B (treasury and mortgage) per month bond run-off (balance sheet reduction program) in place.

While this monetary policy action was in line with expectations, the details of FED's Summary of Economic Projections were shocking. As you can see below, the FED raised its 2023 core PCE inflation estimate from 3.1% in September to 3.5% in December, and reduced its GDP growth estimate for 2023 from 1.2% to 0.5%. In my view, the FED just predicted a recession without admitting to doing so.

Source: Summary of Economic Projections Dec 14th 2022

This data suggests the FED sees an economic slowdown ahead. And yet, FED's terminal fed funds rate outlook has been raised to 5.1% with 17 out of 19 members supporting a terminal rate above 5%. Moreover, the FED now expects to hold rates higher for longer!

My Commentary on FOMC report:

"The Federal Reserve's decision to reduce the pace of rate hikes to 50bps marks the beginning of the end of this rate hike cycle. However, a reduction in pace of rate hikes is not a pivot, and the Fed's quantitative tightening program is likely to continue for the foreseeable future. With the Fed tightening into a deeply inverted treasury yield curve, the near-term environment should be risk-off. Hence, equity markets could see increased volatility in upcoming weeks."

You can read the detailed article here: Federal Reserve downshifts to 50 basis point hike, sees more rate increases ahead

How Are Markets Reacting?

Despite the FED hiking rates by another 50 bps, treasury bonds yields have continued to decline. We have had an inverted yield curve for several weeks now, and it is getting more and more inverted. At this point, it is fair to say that the bond market is fighting the FED! An inverted yield curve suggests that the bond market expects the FED to pivot in the near future by cutting rates and loosening its monetary policy. The markets are betting on a 2018-like pivot from the FED; however, with the inflation genie out of the bottle, I don’t think the FED will step in until and unless something breaks in the economy. And this would mean a severe recession.

In a nutshell, the bond market is suggesting that we are likely on the precipice of a recession. Until recently, equity markets had been rallying higher since mid-October in the hopes of a FED pivot. And declining bond yields did support the idea of higher equity valuations for a short while there; however, a pivot from the FED would happen only if something breaks in the economy. And that is not bullish for equities at all.

From the latest FOMC and subsequent interview of Jerome Powell, we know that the FED will continue to tighten monetary policy for the foreseeable future. And the equity market seems to have finally gotten the memo.

Since the FOMC meeting on 14th December, major equity indices have tumbled lower. Technically, S&P 500 (SPY) has broken a key level at 390, and it could be headed to ~370-375 range in the coming days.

The FED is pulling liquidity out of an overvalued stock market (S&P 500 is trading at ~18.5x forward P/E), and it is fair to say that a financial accident may happen in these conditions. A ~25-50% decline in S&P 500 from current levels cannot be ruled out, and risk management should take precedence in this environment for all investors.

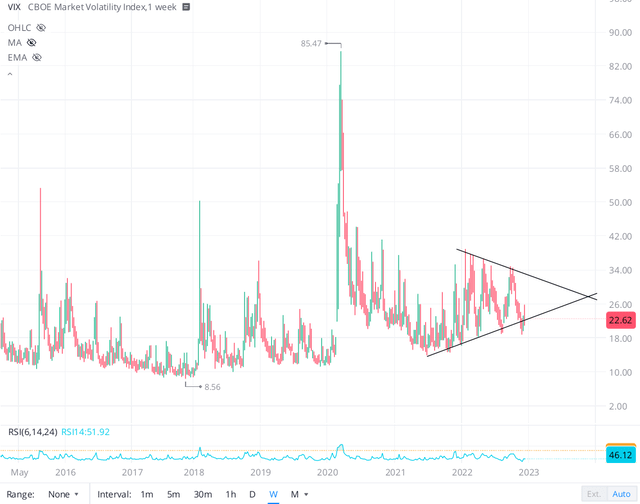

CBOE market volatility index (VIX) is a gauge of fear for S&P 500, and this reading is currently sitting in the low 20s, which is not high at all. So far in this bear market, we have seen measured selling, and I think we will continue to see more selling pressure until VIX climbs back up to the 30s. This level would only be the upper trendline of the symmetric triangle pattern you can see on VIX's chart below.

A true capitulatory bottom in equities is often marked with a 45+ reading on the VIX, and I don't think this bear market will end without such a capitulation.

In our last bi-weekly update at TQI, I said that -

I am more than happy to wait and see if this latest move in equities is a bear market rally (or not) before resuming the accumulation of equities.

Source: Bi-Weekly Portfolio & Market Update + Three Q3 Earning Recaps (CRWD, ZS, OKTA) - December 5th, 2022

Looking at last week's market action, I opine that we were in just another bear market rally during mid-October to late-November period. And now that S&P 500 has broken back into bear territory, I think the stock market is ready for a fresh leg lower.

This market round-up was an abridged version of The Quantamental Investor’s Mid-December Bi-weekly Portfolio and Market Update. If you would like to read our detailed market outlook and access our positioning for this challenging market environment, please join our community at TQI. We’re currently running a Holiday Sale event, and annual membership is just $399 (or $49 per month) if you sign-up before 2nd January. The membership prices will be raised to $899 per year (or $99 per month) once this sale ends. Join now: THE QUANTAMENTAL INVESTOR

What's Ahead...

December 20, 2022 (Tuesday): Notable companies like Nike (NKE) and FedEx (FDX) report earnings that will be closely watched by investors looking to get a pulse check on the health of American consumers.

All week - Futures contracts expiring during the week include the January futures for crude oil and various Treasury contracts. These expirations can lead to more market volatility.

TQI's Research

We find ourselves in a bear market, but that doesn't mean we stop researching for opportunities to make money. Over the last week, we published two research notes, and here's a summary for your perusal:

1) Crowdstrike Q3 Earnings

In 2022, cybersecurity stocks like CrowdStrike Holdings (CRWD) have come under pressure despite robust business performance amidst a challenging macro environment.

In this note, we reviewed CrowdStrike's Q3 report, and determined its fair value and expected returns using TQI's Valuation Model. Also, I briefly discussed CrowdStrike's technical charts. Despite risk of further downside in the stock, I rate CrowdStrike a buy at $115 (with preference for slow accumulation).

You can access the detailed article at Crowdstrike is a falling knife worth catching.

2) Bi-Weekly Portfolio & Market Update + Three Q3 Earning Recaps (MNDY, ASAN, SMAR)

In a TQI Exclusive (pay-walled) report, I shared our market outlook and portfolio updates with TQI's marketplace subscribers. In addition to these recurring bi-weekly market and portfolio updates, I also covered quarterly earning reports of three companies from the work management software space - Monday.com, Asana, and Smartsheet.

You can access the detailed article at Must Read - Bi-Weekly Portfolio & Market Update + Three Q3 Earning Recaps (MNDY, ASAN, SMAR) - December 16th, 2022

Top movers at TQI

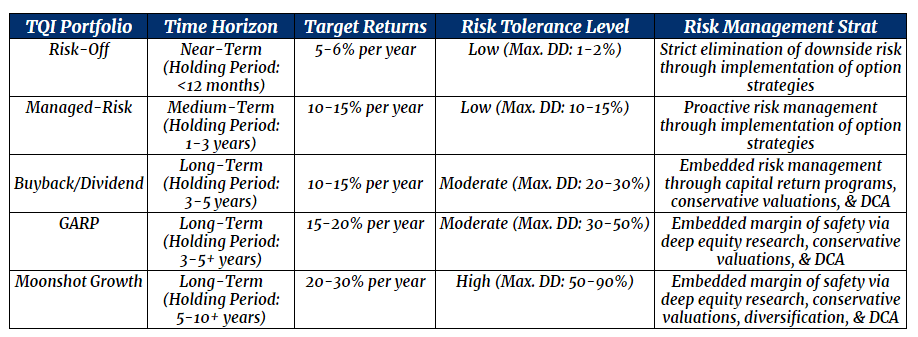

At TQI, we offer multiple portfolio strategies that cater to different stages of an investor's lifecycle. Regardless of your stage on the investor lifecycle curve - Early, Accumulation, or Distribution - The Quantamental Investor has got you covered. Here's a list of our investment mandates:

Here’s a performance snapshot of TQI’s core portfolios since inception on 2nd September 2022:

On an absolute basis, TQI's Buyback-Dividend portfolio is barely in the red with return-to-date performance of -0.25% (measured from inception date: 09/02/2022). Compared to its benchmark, i.e., S&P 500 (SPY), TQI's Buyback-Dividend portfolio is outperforming by +2.04% (as of market close on 12/16/2022). In my view, this strategy is performing exceptionally well in a challenging market. Financial engineering works brilliantly in equity markets if done right!

Since TQI's inception in early September, TQI's growth-oriented strategies have not performed well, with growth stocks continuing to remain under pressure in a challenging macroeconomic environment. In context with the market, TQI's GARP and Moonshot Growth portfolio are underperforming their benchmark (QQQ) by around ~1-1.5%. Since our strategies have a higher beta, I think these portfolios are holding up ok. That said, with roughly half of our options-based tactical hedges now in place, I think we are positioned far better than where we were in TQI's early days, and our returns should improve going forward (regardless of market direction).

Top gainers

The three big gainers for this week were Blend Labs (BLND), DocuSign (DOCU) and Porch Group (PRCH), with stock price increases of 15.32%, 14.46%, and 12.99%, respectively. The post-ER momentum has carried DocuSign higher again this week, but the stock is now looking fully-valued.

With mortgage rates dropping like a rock in the last couple of weeks, beaten-down real-estate technology stocks like Blend and Porch are catching a bid. Blend also happened to report better-than-expected numbers for its recently concluded quarter, which may be the primary factor behind the uptick in the stock. In addition to positive developments on the mortgage rate front, shares of real-estate software platform Porch Group are benefitting from an announcement that its CEO is set to purchase up to $5 million worth of Porch stock.

Top losers

This week's top losers were Shift Technologies (SFT) and Tesla (TSLA), with stock price declines of -27% and -16%, respectively. The news of a potential bankruptcy for Carvana (CVNA) has been weighing heavily on Shift, which has high bankruptcy risk of its own. Shift recently completed its merger with CarLotz, but without an infusion of fresh capital, Shift may not survive beyond 2023. Due to heightened bankruptcy risk, we have placed both Shift and Carvana on our “Avoid/Hold*” list.

Tesla's fundamentals remain strong, and low EV penetration means Tesla could keep growing through this downturn. The balance sheet looks good - no debt, $20B in cash. Tesla is also making positive FCF every quarter, and this is an enviable position compared to other automakers going into a recession.

Tesla is much more than a car company, and we are getting it at a huge discount due to Elon's Twitter antics and obnoxious selling. While I am not happy with what Musk is doing (selling down Tesla to finance Twitter), I think this is an asymmetric risk/reward opportunity for long-term investors. Find TQI's recent research report on Tesla here.

Member Spotlight

The Quantamental Investor is a rapidly-growing investor community, and for this edition of TQI Weekly, we asked one of our first members, Akansha Malara two simple questions:

What does investing mean to you, and how is TQI helping you meet your investing goals?

To which, Akansha said -

For me, investing means planning for important life events well in advance by putting my savings into the right businesses. I invest in companies set to create a positive impact on society and have tremendous growth potential. As an early-stage investor, I have been skeptical about investing during this market downturn, with many of my investments from last year declining significantly. TQI's proactive risk management strategies have stopped the bloodbath in my growth-oriented portfolio and given me the confidence to deploy fresh capital into stocks methodically.

I would like to thank Akansha for sharing her definition of investing with us, and I am sure you have your own story. If you are a TQI Marketplace or TQI Network member, and you would like to be featured in the next member spotlight, please email us at "the.quantamental.investor@gmail.com".

Investing Best Practice Tip

Before you go, take this piece of investing wisdom and internalize it. In his letter to shareholders in 1989, Warren Buffett, one of the greatest investors of all time, said -

It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

This quote suggests that it is better to buy a wonderful business (a company doing well) at a fair price, than a decent business (a company not doing well) at a cheap price. The central idea here is that the company that is doing well will continue to do well and the company that is not doing well will continue to not do well. A great business is likely to possess an economic moat that helps preserve (& grow) its value over a long period of time.

Final Thoughts

Thank you for reading, and I hope you enjoyed this note. Please subscribe to our newsletter to receive the next issue of TQI Weekly delivered directly to your email.

If you want access to TQI's exclusive research and portfolio strategies, please consider joining The Quantamental Investor.

See you next time!